Sports betting has evolved from casual wagers to sophisticated investment-like strategies, with professional bettors employing mathematical models to maximize long-term profits. Among these tools, the Kelly Criterion stands out as one of the most powerful yet misunderstood concepts in bankroll management.

Understanding the Kelly Criterion

Developed by John Kelly Jr. in 1956 at Bell Labs, the Kelly Criterion was originally designed to optimize information transmission rates. However, its application to gambling and investing has made it indispensable for serious sports bettors. The formula calculates the optimal percentage of your bankroll to wager on a bet with positive expected value.

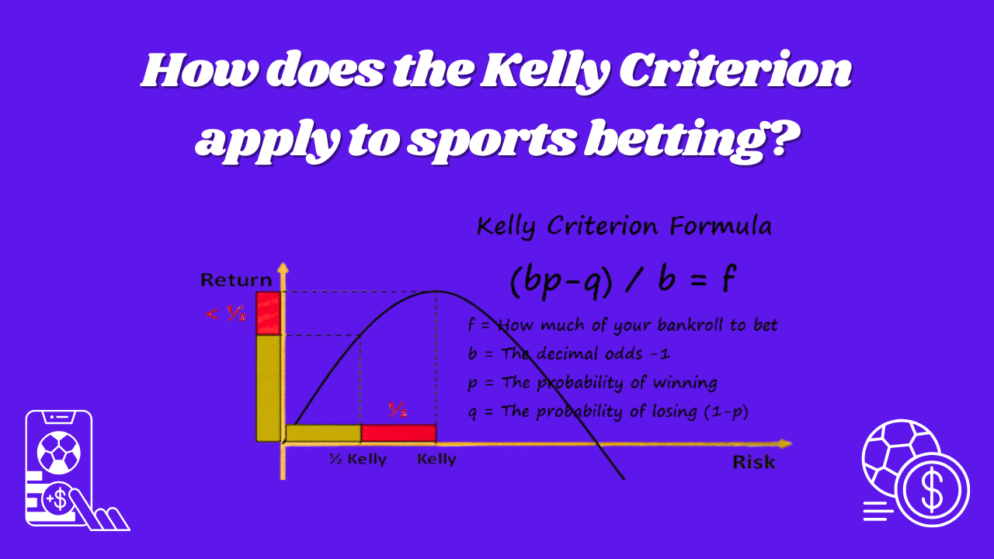

The Kelly formula is elegantly simple: f = (bp – q) / b

Where:

- f = fraction of bankroll to bet

- b = odds received (decimal odds minus 1)

- p = probability of winning

- q = probability of losing (1 – p)

Practical Application in Sports Betting

Consider a football match where you believe Team A has a 60% chance of winning, but the bookmaker offers odds of 2.20 (implying a 45.45% probability). Using Kelly:

- b = 1.20 (2.20 – 1)

- p = 0.60

- q = 0.40

f = (1.20 × 0.60 – 0.40) / 1.20 = 0.233

This suggests betting 23.3% of your bankroll, which seems aggressive but mathematically maximizes long-term growth.

The Power and Pitfalls

The Kelly Criterion’s strength lies in its ability to maximize logarithmic wealth growth while theoretically preventing bankruptcy. It automatically adjusts bet sizes based on edge and odds, betting more when advantages are clearer and less when they’re marginal.

However, full Kelly betting can be psychologically challenging. The recommended bet sizes often feel uncomfortably large, and the inevitable losing streaks can create substantial drawdowns. A string of losses following large Kelly bets can devastate even disciplined bettors emotionally.

Practical Modifications

Most professional bettors use fractional Kelly strategies, betting 25-50% of the recommended Kelly amount. This approach, known as “quarter Kelly” or “half Kelly,” significantly reduces volatility while maintaining most of the growth benefits. The trade-off is slower bankroll growth in exchange for smoother psychological sailing.

Another crucial consideration is the accuracy of probability estimates. Kelly assumes you know the true probability of outcomes, but sports betting involves inherent uncertainty. Overestimating your edge can lead to overbetting and potential ruin. Conservative probability estimates and rigorous record-keeping become essential.

Real-World Implementation

Successful Kelly implementation requires meticulous bankroll tracking and disciplined execution. Each bet should be calculated as a percentage of your current bankroll, not your starting amount. This dynamic adjustment is crucial for the system’s effectiveness.

Additionally, Kelly works best with a large sample size of positive expected value bets. Cherry-picking occasional “sure things” won’t provide the consistent edge needed for Kelly to shine.

Conclusion

The Kelly Criterion offers sports bettors a mathematically sound approach to bankroll management, but it’s not a magic bullet. Success requires accurate probability assessment, emotional discipline, and often conservative implementation through fractional Kelly strategies.

While the math is compelling, remember that no system can overcome poor handicapping or emotional decision-making. The Kelly Criterion is a powerful tool for those who’ve already developed the skills to consistently identify positive expected value opportunities in sports betting markets.

Used wisely, it can transform sporadic betting into a systematic approach to long-term wealth building.